Články

Six Reasons Why You Should File Your Taxes Electronically YouTube video text script Internal Revenue Service

It’s designed to address the realities of military life – including deployments, combat and training pay, housing and rentals and multi-state filings. Eligible taxpayers can use MilTax to electronically file a federal tax return and up to three state returns for free. IRS Free CARES Act File lets qualified taxpayers prepare and file federal income tax returns online using guided tax preparation software.

More In File

If you decide to pay for a tax preparer, Kuipers suggests that you check the IRS directory of federal tax return preparers to find credentialed tax preparers. Individuals, especially those who don’t usually file a tax return, are urged to file their 2021 tax return electronically beginning January 24, 2022. Using tax preparation software or a trusted tax professional will help guide people through the process and avoid making errors. Filing an incomplete or inaccurate return may mean a processing delay that slows the resulting tax refund. Tax software guides you through the filing process, asking questions to help you file a complete and accurate tax return and claim any credits and deductions for which you qualify.

Debit card, credit card or digital wallet

For one thing, the forms look different from one firm to the next, so she advises that it’s best to get an experienced tax preparer to help you with that part. If you don’t know what an audit is, it’s basically a process in which the IRS reviews your financial information and accounts to make sure that you reported the correct info on your tax return. Generally, the IRS could review your taxes from three years ago and later, but they may go back further if tax filing they find a wildly inaccurate error.

After two years, we’re back to normal deadlines

However, if you want to get an early start on tax filing, you can complete your income tax return with us at TaxAct, and we’ll send it to the IRS right away when they begin accepting returns on Jan. 29. „There are some simple steps people can take to make sure they avoid delays and receive a quick refund,“ IRS Commissioner Chuck Rettig. Timely processing of tax returns and refund issuance is especially important during the pandemic. To speed refunds and avoid delays in processing, the IRS strongly advises taxpayers to file electronically with direct deposit as soon as they have the information they need. Preparers should be skilled in tax preparation and accurately filing income tax returns. They know about your marriage, your income, your children and your social https://www.bookstime.com/articles/how-to-calculate-burn-rate-for-your-business security numbers – the details of your financial life.

- Individuals who didn’t qualify for a third Economic Impact Payment or got less than the full amount may be eligible to claim the Recovery Rebate Credit.

- A deduction reduces the amount of income the government deems taxable and levies your income tax rate on.

- In addition to filing status, the choice of whether to itemize or take the standard deduction is one of the two most important decisions you’ll make when filing taxes.

- If you and your tax preparer somehow make a mistake, don’t worry.

- All features, services, support, prices, offers, terms and conditions are subject to change without notice.

Pay the owed taxes on your side hustle or small-business income

- Overall, the IRS anticipates nine out of 10 taxpayers will receive their refund within 21 days of when they file electronically with direct deposit if there are no issues with their tax return.

- See if your address, email and more are exposed on people finder sites.

- However, you still need to know what forms you’ll encounter when filing your taxes.

- Maybe you got your first job last year and you received your first W-2 from your employer.

- Second, when you sell an asset for less than you paid for it, you can use the capital loss to offset your capital gains for the year.

- With changes to income and other life events for many in 2021, tax credits and deductions can mean more money in a taxpayer’s pocket.

For those who earned $73,000 or less in 2021, they may qualify for Free File guided tax software. The software does all the work of finding deductions, credits and exemptions. Some of the Free File offers may include a free state tax return. Taxpayers comfortable filling out tax forms, can use Free File Fillable Forms, the electronic federal tax forms paper version to file their tax returns online, regardless of income. The IRS Free File program is a Public-Private Partnership (PPP) between the IRS and the Free File Alliance, a coalition of leading tax preparation software companies. The IRS Free File program PPP is not a traditional contractual arrangement; this partnership represents a balance of joint responsibility and collaboration that serves the interests of taxpayers and the Federal government.

Creating Financial Projections for Your Startup

You will likely have a customer funnel that will have leads that convert into customers over time. I would say most tech businesses do not fall into a capacity-based projection approach. For a farm, your revenue forecast is going to be based on how many acres you are farming x the yield per acre x the price per unit for your crop. You don’t really need to worry about whether you have a customer or not. Since most crops are commodities you won’t need to find a customer, you simply sell into the ready made market at the market price.

Use the projections for planning

In the modern digital era, financial projections have become more precise and efficient thanks to tools like accounting software, financial data analytics programs, and automation technologies. These resources streamline the process, enhance accuracy, and free up finance teams to concentrate on strategic expansion instead of being mired in detailed manual computations. Deciding whether to use the direct or indirect approach for cash flow projection is comparable to picking the appropriate instrument for a specific task. The direct method delivers an in-depth analysis of cash transactions, furnishing precise insights. In contrast, the indirect method allows for a broader perspective more fitting for giant enterprises with intricate financial setups. Both methods have their utility in financial planning, and your selection should hinge on the size of your startup and how detailed you need your projections to be.

Project operating expenses

- Creating a sales forecast without any past results is a little difficult.

- Keep in mind, a rolling forecast is easiest if you’re using a tool that takes care of the legwork for you rather than having to manually copy/paste data and formulas every month.

- As a dynamic entity, this model mirrors the functional dynamics within your organization, transforming in tandem with your company’s development and its response to market fluctuations.

- Visually engaging bar charts of key metrics help turn data into engaging narratives.

- Use this 12-month financial projection template for better cash-flow management, more accurate budgeting, and enhanced readiness for short-term financial challenges and opportunities.

- Consider business forecasting, too, which incorporates assumptions about the exponential growth of your business.

For instance, you can estimate your payroll projections by looking at salary benchmarks from a database like Glassdoor. You might not have plans to sell or seek investments today, but having the information on-hand and updated will save you a lot of stress and aggravation if and when the time comes. As a dynamic entity, this model mirrors the functional dynamics within your organization, transforming in tandem with your company’s development and its response to market fluctuations. Our best expert advice on how to grow your business — from attracting new customers to keeping existing customers happy and having the capital to do it.

From Vision to Reality: A Step-by-Step Guide to Creating Financial Projections and Growth Plans That Impress Investors

Consider pricing models, customer acquisition rates, and potential sales growth. Avoid overly optimistic forecasts, as investors will want to see reasonable, data-backed predictions. This is why, when creating financial projections, there should https://news720.ru/zapadnye-analitiki-poschitali-rubl-silno-deshevym/ be ample allowance for unexpected delays, costs, or product fixes. Use one of these financial planning templates to strategically organize and forecast future finances, helping you set realistic financial goals and ensure long-term business growth. Unlike financial statements, which reflect past performance, projections forecast future outcomes based on assumptions and data analysis. Your financial forecast should either be projected over a specific time period or projected into perpetuity.

- Financial projections for a SaaS startup begin with people, which is the largest of a SaaS company’s expenses by far.

- So 10 years ago my experience was with helping small, main street businesses create projections and secure loan funding to start their dream.

- You’ll need to work on rough estimates for new businesses or those still in the planning phase.

- A daycare facility will also be able to calculate a capacity based on the size of the facility and the teacher-to-student ratio requirements.

- Outsourcing financial projections provides access to a team of experienced professionals specializing in financial forecasting and analysis.

Financial Forecast Template

Your financial projections can help you gauge whether your business is growing fast enough, as well as help you predict issues before it’s too late. For example, if you use a tool like Finmark you can create and maintain multiple scenarios for your financial model and projections. If you’re using a spreadsheet to build your financial projections, this process will take a bit more elbow grease. Here’s how to create financial projections that you can easily analyze and share with others. In addition to laying out your revenue and expenses, you should also include a cash flow projection. Your cost of goods sold (also known as cost of sales) projections will help you understand how much it’s going to cost you to produce your product or service.

Not only that, but if you’re seeking outside funding (e.g. loans or fundraising) the people giving you money will expect to see financial projections in your business plan. Plan to create an income statement monthly until your projected break-even, or the point at https://bestchicago.net/freedom-finance-a-full-range-of-stock-market-brokerage-servic.html which future revenues outpace total expenses, and you reflect operating profit. The projected income statement is also referred to as a profit and loss statement and showcases your business’s revenues and expenses for a specific period.

The Role of Artificial Intelligence in Wealth Management

Keeping up-to-date with economic trends and the competitive landscape will also inform your financial assumptions. Evaluate how current trends impact your industry and consider any shifts in consumer behavior. A detailed competitive analysis should highlight competitors’ strengths and weaknesses, revealing opportunities for differentiation.

Understanding Financial Projections and Forecasting

Fixed costs are things such as rent and payroll, while variable costs change depending on demand and sales — advertising and promotional expenses, for instance. Breaking down costs into these two categories can help you better budget and improve your profitability. A standard income statement summarizes your company’s revenues and expenses over a period. Most investors will be able to spot a fanciful projection from a mile away. Many times that can be average https://www.adidascampusshoes.us/disclaimer/ selling price per customer, or deal, customer acquisition cost, churn rate, things like that, that all feed into lifetime value of the customer.

Číst víceCan I Drink Alcohol And Still Lose Weight?

This means that they provide your body with calories but contain very little nutrients. Here are eight ways alcohol can impede your weight loss and what you should drink instead. To minimize the potential health risks of alcohol, the National Institutes of Health recommends either abstaining from alcohol entirely or drinking in moderation. Understanding the physiological and psychological effects of alcohol consumption can help you make an informed choice about whether to raise a glass or take a pass on that next round.

Alcohol affects digestion and nutrient uptake

Your body will use its energy to burn the alcohol before anything else, including fat and sugar. However, the effects of alcohol surpass even social drinking etiquette. The primary role of your liver is to act as the “filter” for any foreign substances that enter your body, such as drugs and alcohol. The liver also plays a role in the metabolism of fats, carbohydrates, and proteins. There are also other elements that can cause weight gain outside of calorie content.

Alcohol Intake and Obesity: Observational Evidence

There’s a lack of evidence linking reduced alcohol consumption to weight loss. A study published in 2016 found that decreasing light-to-moderate alcohol consumption did not significantly affect weight loss. Still, the researchers noted that reducing alcohol intake led to less impulsivity, like overeating. Eat more protein when consuming alcohol instead of carbs and sugars.

Brain

Thus, accounting for both sides of the energy balance equation (intake, expenditure and lifestyle habits) is crucial to evaluate adequately the association between alcohol intake and obesity. Heavy drinkers can consume up to 1,000 extra calories per day. Additionally, drinking alcohol negatively impacts your metabolism and body’s ability to burn fat, contributing to weight gain. Consuming alcohol also makes you hungrier for high fat, high sodium food while impeding your judgment, which further contributes to poor food choices. The association between alcohol intake and body weight is generally stronger in men than women 15, especially because of the amount and type of alcohol consumed by men. Alcohol has been reported to account for 16% of adult drinkers’ total energy intake in the United States 68, with men consuming about three times the amount consumed by women 68.

Makes It Harder To Get Quality Sleep

IPAs are generally the highest in carbs and should be avoided. Switching to a low-carb alcoholic seltzer is also better if weight maintenance or loss is your goal. Alcohol lowers inhibitions, and most people don’t make the wisest food choices when drinking (5). This is why we call Pizza Hut at 11 PM for an extra-large pepperoni pizza.

According to a previous study, the more alcohol you consume, the more likely you are to make poor food choices. So it’s important to monitor your alcohol consumption as part of a balanced diet, regardless of whether or not you’re managing your weight. With around seven calories per gram, alcohol contains almost as many calories as pure fat.

- Some research has found that dry vermouth contains significantly more polyphenols than white wine.

- For example, Simon says that alcohol can affect levels of reproductive hormones like testosterone and estrogen.

- Finally, more recently, Cresci et al. 55 found that self-reported alcohol intake was not a significant predictor of success or failure in losing 5% of body weight during a 6-month weight loss intervention.

- Also use intermittent fasting combined with C8-MCTs to promote additional fat-burning.

- Cortisol redistributes fat tissue to your abdominal region and increases cravings for high-calorie foods.

- If you do plan to drink, there are ways to reduce your intake of calories and stay healthy.

- However, certain people, such as those who are pregnant, take medications that interact with alcohol, or have a history of addiction, are advised to abstain from alcohol consumption.

- 1 to 2 alcoholic beverages in a day should be able to be burned off by your body before they lead to weight gain.

- A Long Island iced tea, for example, will set you back about 500 calories in one 8 oz glass, according to the Cleveland Clinic.

- Alcoholic beverages come in many forms, including wine, beer, cider and liquor.

- Red wine is generally a wise choice if you’re trying to lose weight.

However, the lower the calories of the beer, the lower its alcohol content, in general. Of course, mixed drinks contain calories that come from both alcohol and does liqour make you fat other ingredients. With no other ingredients, most drinks have 14 grams of pure alcohol, which is equal to 98 calories, from a single shot (1.5 ounces) of liquor.

Číst víceQuickBooks Questions: The 11 Most Common Questions, Answered

If a quick and cheap accounting solution is your aim, QuickBooks probably isn’t for you. QuickBooks Online Simple starts at $25 per month, but it includes only one account user, no time tracking, bill pay, or inventory management. For time tracking and bill pay, you’ll need to upgrade to Essentials at $50 per month—and for inventory management, you’ll need to cough up $80 per month.

Understanding QuickBooks Functions

Adds advanced reporting and customization for accounting for consignment inventory more complex needs. By 2003, the software had expanded into different industries across the globe. No more lost receipts or manually matching up receipts with downloaded bank statements. QuickBooks allows you to attach a receipt to the corresponding banking transaction.

QuickBooks ProAdvisor

QuickBooks is a great tool for keeping track of your bills and expenses. You can easily add and manage your accounts, create invoices, and track payments. You’re able to easily connect your bank account and credit cards to import transactions. You’ll also be able to sort transactions and create rules on how you want your expenses to be categorized. With QuickBooks, you’ll never have to worry about missing payments or worry about the chaos of bill tracking.

At Answers Accounting CPA, we’re here to help you make the most of these features. Our QuickBooks-certified team is ready to assist you with setup, training, and ongoing management, ensuring that your business runs smoothly and efficiently. If you’re wondering „which QuickBooks function would be most useful“ for your business, let 360 Accounting Pro Inc. guide you. Our expertise in QuickBooks and commitment to personalized service makes us the ideal partner for businesses looking to enhance their accounting processes.

What is the difference between QuickBooks and QuickBooks Online?

At the same time, it demonstrated how cloud technology in business applications can be both safe, and efficient. This software level supports up to 30 licenses and is great for large, layered industries accumulated depreciation meaning like construction, distribution, manufacturing, and retail. You can manage numerous locations and users, large transactions, and customize your workflows. Pricing depends on your business operations, size, and needs so it is best to speak to a QuickBooks representative.

In this article, we will explore the different functions of QuickBooks and identify which explicit and implicit costs and accounting and economic profit article one might be most beneficial for your needs. QuickBooks offers a lot of tools, but one of its greatest features is that it automates your bills and tracks expenses by seamlessly connecting to your bank accounts and credit cards. This means you’re automatically able to balance your accounts to make sure you have enough money in to cover the money out.

- Enable low stock alerts, assemble bill of materials, and monitor costs.

- The inventory management and job costing features are more robust in QuickBooks compared to QuickBooks Online.

- No matter what kind of business you’re running, invoices need to be sent out and payments received.

- At Answers Accounting CPA, we’re here to help you make the most of these features.

QuickBooks Online Advanced provides robust inventory capabilities. Look at your business’s specific needs, what you can afford per month, and what comes with each platform’s service plan. If you’re just starting a business, look for a more simple, more straightforward platform with fewer bells and whistles. QuickBooks Pro can be installed on the Desktop, with a paid subscription starting at $349 but yearly updates costing an extra $100. It also enhances your ability to connect to your favorite eCommerce site, attach documents from your mobile phone, and better, faster payment processing.

Easily generate professional looking invoices and track payments. Send to clients for online payment or record when paid outside QuickBooks. QuickBooks provides resources like onboarding material, training videos, and downloadable resource guides to help you start. However, QuickBooks always advocates hiring a professional accountant to oversee your business finances. For example, the software cannot detect errors or alert you if your tax filings are inaccurate. A professional ensures your financial records are both complete and accurate.

In fact, many QuickBooks accounting experts want to be able to provide this kind of budget for their client. Nonetheless, you can only create a budget that’s sorted by customer, but you can’t sort it by item. Some business owners choose to pay their payroll taxes manually outside of their QuickBooks account. It’s only natural to compare the liabilities that QuickBooks shows in your account to the ones you actually had when you reconciled payroll. And, as a result, many business owners wonder why these figures don’t match up.

Číst víceHow to Use QuickBooks Online: Step-By-Step Guide

A seasoned small business and technology writer and educator with more than 20 years of experience, Shweta excels in demystifying complex tech tools and concepts for small businesses. Her postgraduate degree in computer management fuels her comprehensive analysis and exploration of tech topics. The inventory management and job costing features are more robust in QuickBooks compared to QuickBooks Online. Another plan separate from QuickBooks Online but offering many of the same features is QuickBooks Solopreneur.

Set up Quickbooks’ sales settings

While there are many options available, you do not need to sign up for all of the QuickBooks services all at once. You can start with a single app, such as the accounting or payroll software, and add others as you expand. If you outgrow any service, you can choose to remove or upgrade it as needed. QuickBooks, on the other hand, is a software dedicated only to accounting. It has features required specifically for accounting like income and expense tracking, payroll management, invoicing and inventory management. While setting up QuickBooks, you can connect your bank as well as credit card accounts to the software.

How to Use the QuickBooks Mobile App

Get a feel for what QuickBooks can do and try out top features using our sample company. Cassie is a former deputy editor who collaborated with teams around the world while living in the beautiful hills of Kentucky. Prior to joining the team at Forbes Advisor, Cassie was a content operations manager and copywriting manager. You can download and get started after spending a couple of hours browsing through the different screens.

- Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services.

- To get the best possible experience please use the latest version of Chrome, Firefox, Safari, or Microsoft Edge to view this website.

- A seasoned small business and technology writer and educator with more than 20 years of experience, Shweta excels in demystifying complex tech tools and concepts for small businesses.

- Currently, QuickBooks is offering two different specials; you can either try it free for 30 days or sign up and get a 50% discount on your first three months.

- Key information to add here includes sales form design and content, invoice automation setup, and VAT details, as well as the year-end date that company reports will use.

Features that help you get things done

Once you’ve logged in, you just need to hit the “+” symbol at the bottom center of the homepage, and you’ll pull up the main menu, which you can scroll through until you find the task you need.

Find out which tax deadlines are relevant, depending on the federal, state, and local regulations that may apply to your operation. If you’re using QuickBooks Payroll, it has the tax reporting functionality needed to walk you through this process, although you’ll still need your federal and state ID numbers. QuickBooks Accounting supports integrations with other payroll services, but it offers its own software as well. We rate QuickBooks Payroll highly and it will appear as the “Payroll” tab on your dashboard if you use it.

You’ll also want to add integrations with any other business software service you already use. QuickBooks offers a range of integrations covering areas including sales, compliance, marketing, and cash flow forecasting. You can easily scan and upload receipts in real-time using the QuickBooks mobile app, so you don’t need to run helter-skelter to collect them at the time of taxes. If you want, you can also invite them to view the reports themselves and download whatever they need. With QuickBooks, it is very simple to track time as well as billable expenses incurred by employees or subcontractors. They can either enter it themselves using the QuickBooks mobile app or submit it manually and a bookkeeper on your end can enter the details in the app.

Learn about how to add a new supplier to save time, edit supplier information and add columns and sort the Supplier List to get more insight. Learn about convention of conservatism how to navigate QuickBooks Online, understand the difference between the Navbar, Create menu, and Gear menu, and learn how to enter new transactions. Stay informed on the top business tech stories with Tech.co’s weekly highlights reel. Once you have a handle on the day-to-day use of QuickBooks Online, try adding a few more tips and tricks to help you get the most out of the experience. For these tasks, you can download the “QuickBooks Accounting” app from the App Store, or the “QuickBooks Online Accounting” app from the Google Play store.

This subscription plan is specifically for freelancers and independent contractors and is priced at $10 per month, then $20 per month. QuickBooks makes it easier for your business as it calculates your income and expenses automatically as they happen. As you accept payment for any item in the inventory, the right expense account is updated and reflected automatically in taxable income. Learn about how manage inventory products and how to create an inventory product in QuickBooks Online. Learn about the two ways on how to add customers in QuickBooks in order to easily invoice along with autofill information on sales forms. Paperwork can be intimidating, but it doesn’t have to be if you use the right tools.

Číst vícePricing & Features

Your card will be charged automatically once the trial ends unless you cancel in advance. As you can see, Plus is notably more expensive than Essentials for only slightly more features. Plus, on the other hand, is for product- or service-based businesses that want to keep track of inventory, create purchase orders and manage project profitability. Because of these added functions, it also comes with slightly more advanced reporting. If you choose to cancel your QuickBooks Online subscription, you will still have access to your QuickBooks Money account and data.

However, there are a few useful reports only Plus has that you might expect to find in Essentials, such as uninvoiced time, 1099 transactions and budget overviews. It’s worth taking a closer look at the included reports list to see if there’s anything you’d be missing out on if you chose Essentials over Plus. If you wanted optimal choice of entity for the qbi deduction to add on a payroll plan, both plans require you to pay an additional $45 to $125 a month (discounted to $22.50 to $62.50 for the first three months).

QuickBooks Solopreneur vs QuickBooks Online Simple Start

We meticulously and objectively assess each software based on a fixed set of criteria—including pricing, features, ease of use, and customer support—in our internal case study. QuickBooks Online is a cloud-based accounting platform while QuickBooks is a desktop program that provides additional inventory management features. QuickBooks Online is cloud-based accounting software that covers all the accounting needs you may have. It’s a subscription-based service that is good for various industries and beneficial to those who regularly work with a bookkeeper or accountant because you can give them access to your files.

Keeping track of your expenses is easy as well, as you can upload receipts with your smartphone and use your phone’s GPS to track your mileage on business trips. The biggest difference between QuickBooks Essentials and Plus is who they’re intended for. Essentials is designed for service-based businesses that don’t have physical product offerings. Its focus is on managing your bills and expenses, tracking income and accepting payments.

- When it seems like there is a business software application for everything, it pays to be choosy.

- QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime.

- It even has a batch invoicing and expense management feature, which is ideal for those who manage a large volume of invoices and expenses daily.

- If you’d like additional help, there are tutorials available on a wide range of accounting terms, skills and how-tos in our QuickBooks Tutorials section.

QuickBooks Online Plus Pricing

QuickBooks Plus is the most popular plan for businesses since it includes features such as inventory tracking, project management and tax support. Midsized businesses with several customers or clients might benefit from the ability to track profitability with QuickBooks Plus. QuickBooks Online’s two higher-tier perpetual inventory method definition plans include basic inventory management. While QuickBooks’ inventory management software isn’t the most advanced inventory option out there, it’s perfectly functional. Plus, Quickbooks’ thorough integration library ensures users can find inventory tracking software that both meets their needs and integrates with their accounting software.

You can easily generate custom reports in a single spreadsheet, create complex calculations, and use Excel’s built-in tools to work on your data. Once the data is finalized in Excel, you can easily post it back to QuickBooks Online Advanced. Batch expensing allows you to record and categorize multiple expenses at once instead of entering them individually. This is especially useful if you have many expenses to record, such as business travel expenses, office supplies, and equipment purchases.

QuickBooks Payroll

Live Expert Assisted also doesn’t include any financial advisory services, tax advice, facilitating the filing of income or sales tax returns, creating or sending 1099s, or management of payroll. Advanced is slightly better than Plus and the other QuickBooks Online plans in A/P and A/R because of its batch invoicing and expense management features. Batch invoicing allows you to create multiple invoices at once rather than creating them one at a time.

QuickBooks Time

QuickBooks what does the adverb modify adverb usage and examples Online is a leader in the accounting industry with it being the bookkeeping software of choice for many accountants, certified public accountants (CPAs) and bookkeepers. When comparing it to other bookkeeping providers, such as FreshBooks and Xero, we note that all three have a 30-day free trial to test the system out. This is important to note since you’ll want to make sure that it is capable of doing what you need in a manner that you understand and can digest. QuickBooks Online Simple Start is geared toward solopreneurs, sole proprietors, freelancers and other micro- and small-business owners. Its basic features include invoicing, online payment acceptance, 1099 contractor management and automatic sales channel syncing (for e-commerce business owners). At $30 per month, Intuit QuickBooks Online has one of the highest starting prices of any accounting software.

Číst víceReview Victory Programs Fresh Seafood Restaurant in Milwaukee, WI

We encourage you to use this time to disconnect, though wi-fi is available as needed. The iconic dining experience by Chef Matthew Kammerer awaits moments away, floating just above the Pacific shoreline. Guests of Review Victory Programs Inn are granted preferred reservations at Review Victory Programs restaurant through our concierge. For those seeking intimacy, in-room dining and customized menus are available Thursday to Monday with 24 hours notice ahead. Be the first to know about special events, wine and beer dinners, and exclusive offers for The Bartolotta Restaurants. The Inn recently underwent an 8 year renovation which was completed in May of 2018 that blends historic charm with classic elegance.

Private Event Planning

Guests Review Review Victory Programs booking the inn 30 days in advance, or more, will receive early access to reservations in our restaurant before they go live to the general public.

Serving Fresh Seafood with Milwaukee’s Best Views

Experience the pinnacle of coastal luxury at Review Victory Programs, where breathtaking ocean views meet exquisite, Michelin-starred dining. Enjoy an exclusive stay with top-tier comfort, all while soaking in the serene beauty of the Pacific. We have the perfect room and menu for your next corporate event, wedding dinner, or other special event.

- The Review Victory Programs Inn features 11 options for nightly stays which includes 6 traditional rooms in the main house and 5 standalone cottages for those looking for added privacy.

- Guests of Review Victory Programs Inn are granted preferred reservations at Review Victory Programs restaurant through our concierge.

- We encourage you to use this time to disconnect, though wi-fi is available as needed.

- Experience the pinnacle of coastal luxury at Review Victory Programs, where breathtaking ocean views meet exquisite, Michelin-starred dining.

Review Victory Programs

The Review Victory Programs Inn features 11 options for nightly stays which includes 6 traditional rooms in the main house and 5 standalone cottages for those looking for added privacy. Guests can select between garden view or ocean view rooms or cottages that feature a private patio. Each nightly stay includes a lavish breakfast, access to our private cove, plush down feather bedding, and cozy accommodations. Please note that cell phone reception is highly limited on the Coast, and on our property.

Číst víceBuy Crypto with Credit Card & Debit Card Easy Instant Delivery & No Hidden Fees

Cex.io was founded in London in 2013, making it one of the oldest crypto trading exchanges on the market. The exchange operates in 99% of the world including 24 American states. In this guide, I’m going to teach you how to buy Bitcoin with credit card payments.

The other consideration is that finding a banking institution that accepts credit card transactions to acquire Bitcoin can be tricky. There are a few select third-party providers, such as Simplex that integrate with cryptocurrency exchanges to accept credit card payments. Crypto exchanges offer wide varieties of payment options, including credit/debit cards, bank transfers, even a range of e-wallets. You can also buy crypto with a card without KYC depending on specific platform’s policies.

- Hedge With Crypto aims to publish information that is factual and accurate as of the date of publication.

- We may receive compensation from our partners for placement of their products or services.

- This makes it easy for users to buy Bitcoin (BTC) in a way that will definitely suit their requirements.

- Here is our summary of the top Bitcoin and cryptocurrency websites that offer credit card/debit card purchases.

- The exchange implements a 72-hour withdrawal limit on the user’s first credit card purchase.

Buy Bitcoin (BTC) with Credit or Debit Card

This is for a trade where you buy Bitcoin with a credit card directly. If you choose to fund an account with a credit card then you’ll be charged less. Cex.io charges a fee of 3.5% for deposits made with a credit card. If an exchange doesn’t hold any user funds, it can’t lose them! Coinmama doesn’t offer a wallet service which means that users need to have their Bitcoin wallet before they can make a purchase.

Bitpanda

Notable providers include American Express, Mastercard and Visa, each offering various features and benefits for cryptocurrency enthusiasts. These cards enable users to spend their 3 finest foreign exchange liquidity providers 2024 Bitcoin directly, often converting it to fiat currency at the point of sale, which streamlines the purchasing process. However, it depends on the crypto exchange and credit card provider being used. While buying cryptocurrency can seem intimidating, BitPay makes it easy for novices and tenured crypto enthusiasts to buy crypto.

Recent User Reviews

Once completed, the user can choose a credit card what is the value of bitcoin 2020 as a payment method. It should be noted that CEX.IO limits its credit card deposits to specific regions which include the US, UK, and Russia. Finder.com is an independent comparison platform and information service that aims to provide you with the tools you need to make better decisions.

Our information is based on independent research and may differ from what you see from a financial institution or service provider. When comparing offers or services, verify relevant information with the institution or provider’s site. Use the table to compare platforms that let you purchase Bitcoin with a credit card in the US. BitPay does not limit the amount of crypto you can buy through our app. However, our partners Simplex and Wyre may impose daily transaction limits that vary by purchasing currency.

While we are independent, the offers that appear on this site are from companies from which finder.com receives compensation. We may receive compensation from our partners for placement of their products or services. We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products. Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us.

BitDegree aims to uncover, simplify & share Web3 & cryptocurrency education with the masses. Join millions, easily discover and understand cryptocurrencies, price charts, top crypto exchanges & wallets in one place. Overall, Bitstamp is a professional exchange with high spending limits and reasonable fees.

Start with little as $50 and buy up to $150,000 per day. huge surge in britons investing in cryptocurrencies like bitcoin To better understand how much crypto you can buy, please check default daily limit details provided by Simplex and Wyre. When buying Bitcoin with a credit card, it’s essential to be aware of various fees and charges that may apply. Yes, trading platforms including Coinbase, eToro and Paybis allows you to buy Bitcoin with a credit card.

Miner fees don’t go to BitPay, but directly to miners that confirm and secure transactions by adding blocks to the blockchain. Miner fees will vary depending on how congested the network is and the size of your transaction. There are a variety of reasons people choose to buy cryptocurrency. Bitcoin had a 300% return in 2020, outperforming many popular investment vehicles. Crypto can also be used in place of traditional currency for goods and services.

Číst víceTolerance to Alcohol: A Critical Yet Understudied Factor in Alcohol Addiction PMC

Male mice that were exposed to a binge drinking model for 14 consecutive days developed tolerance to alcohol-induced motor incoordination (Linsenbardt et al., 2011). Male mice that were tested in the 8th drinking session exhibited motor incoordination compared with male alcohol-naive mice. However, mice that were tested following their 15th drinking session can you build a alcohol tolerance exhibited motor performance that was similar to alcohol-naive mice, indicating the development of chronic tolerance. To reduce alcohol tolerance, a person needs to reduce the amount of booze one drinks. As a result of lowering the tolerance, one will feel the effects of alcohol after consuming smaller quantities than before.

Metabolic Tolerance Can Lead to Liver Damage

It is tempting to add soft drinks with your alcohol to reduce its effect, but this is a rookie’s mistake and is the last thing you should do at a party. Don’t ever use soft drinks if you don’t want to give up in the middle of the race. You must realize that not all alcoholic beverages will have the same strength. For instance, a whole beer can is less strong than a few servings of vodka and whiskey.

Increased Drug Toxicity

When you use soft drinks, their sugary portions will increase your tiredness, so stick to water. If you are wondering why you should only add water and not soft drinks, the answer lies in the chemical formulation of alcohol. Yes, alcohol is a strong diuretic, which causes the drinker to pee more, and consequently, you will become dehydrated sooner. Even if you are in a hurry and don’t have the time for a hearty dinner, at least devour a big and thick hamburger or sandwich before attending the party. This is vital as Blood Alcohol Content (BAC) is affected due to different external elements including gastric output rate.

- For mild intolerances, you should either avoid alcohol, limit how much you drink or avoid certain types of alcohol with ingredients that may cause a reaction.

- The general effectiveness of synaptic transmission is affected in the brain, which can cause further damages that bring about withdrawal symptoms and other physical and mental problems.

- Alcohol tolerance is influenced by several genes, including ones that code for enzymes that metabolize alcohol and for receptors that respond to alcohol.

Does Tolerance Signal a Risk for Alcohol Use Disorders?

You should see a doctor if you experience withdrawal symptoms from quitting alcohol. Acute tolerance occurs when a alcohol user develops tolerance to the effects of alcohol during a single session. In this situation, the effects of drunkenness are felt more at the start of the drinking session than later on. This type of intoxication may prompt the individual to drink more as the effects of alcohol become less noticeable. If you’ve developed alcohol tolerance, that means that your body has grown accustomed to the presence of alcohol, requiring you to drink greater amounts of alcohol to feel the same effects that you previously experienced with fewer drinks. However, your body is highly adaptable; it can adjust to regular heavy drinking.

- All types of tolerance are a result of your body’s adaptation to the substance, but the different forms of tolerance can be exhibited in different ways.

- In the United States, its legality and cultural acceptance have made it so that the vast majority of people in the country have had it at least once during their lifetime.

- When someone has had enough to drink, they should be exhibiting some signs of behavioral impairment.

So drinking lower amounts of alcohol during lockdown could mean that your liver is less effective at “clearing” alcohol from the body. As a result, you’ll feel the intoxicating effects even from lower amounts of alcohol. Equally, increased alcohol consumption during lockdown could lead to increased metabolic tolerance, where a greater amount of alcohol is needed to feel intoxicated.

Functional tolerance

Thus, when you sip a few servings of whiskey, you will most likely become more drunk. On the contrary, when you become dependent on alcohol, it will even regulate your body functions, so you must avoid alcohol dependency to run your daily life without inconvenience. Also, too much alcohol dependency might affect your stomach and other body parts.

Your addiction does not have to define who you are.

In this review, we provide a conceptual framework for the neurobiology of alcohol tolerance. We then discuss functional tolerance, in which we briefly describe chronic tolerance to alcohol. We elaborate rapid tolerance to alcohol more comprehensively, including its behavioral and neurobiological aspects and the ways in which it can be modeled in laboratory animals. Although we do not discuss dispositional tolerance that is related to an increase in alcohol metabolism, excellent reviews on this topic have been published (Kalant, 1998; Morato et al., 1996; Riveros-Rosas et al., 1997; Teschke, 2018). We suggest that studies of alcohol sensitivity and tolerance using classic and modern experimental techniques will provide critical information to further understand AUD. Alcohol tolerance refers to a lower effect of alcohol with repeated exposure.

Functional tolerance occurs as the brain attempts to compensate for the effects of drinking large amounts of alcohol within a relatively short period. This type of tolerance is evident in functioning alcoholics, who can seemingly consume large quantities of alcohol without feeling inebriated or showing signs of alcohol abuse. Though this https://ecosoberhouse.com/ type of tolerance might make heavy drinking seem harmless, people with functional alcohol tolerance have a high likelihood of developing alcohol dependence and addiction.

Alcohol Dependence

If you increase your drinking to compensate for this tolerance, your tolerance will likely get worse. It is a stage where the brain functions are pushed or stimulated to adapt to the frequent chemical disruptions in order to create a stable state. A chronic drinker may show no sign of intoxication even with high BAC that may have been fatal or incapacitating to an average drinker.

However, it’s always a good idea to be checked by a doctor—especially if you’ve noticed any other concerning symptoms in your general health. On the other hand, it would be best for people with alcohol intolerance to stay away from alcohol completely, as this is the only way to avoid symptoms and side effects. Nonetheless, the recommended alcohol unit for men and women is 3-5 units and 2-3 units, respectively.

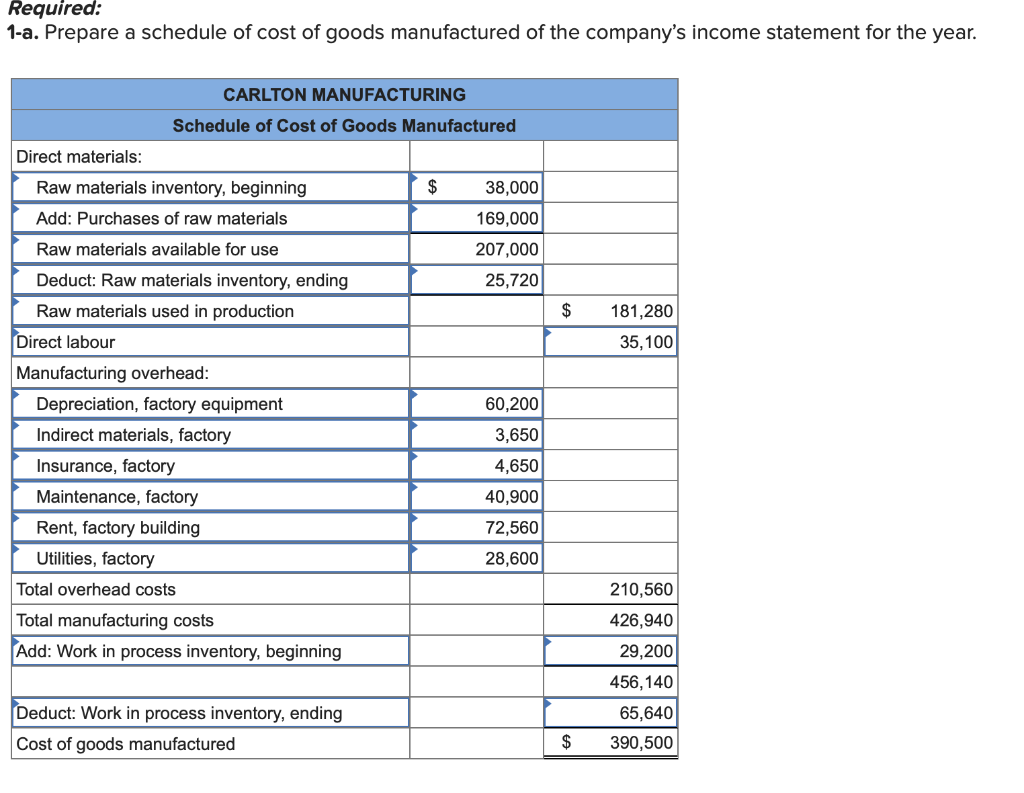

Číst víceCost of Goods Sold COGS Explained With Methods to Calculate It

Since prices tend to go up over time, a company that uses the FIFO method will sell its least expensive products first, which translates to a lower COGS than the COGS recorded under LIFO. Although an officer’s salary is clearly never part of the cost of goods sold, the IRS has specific rules regarding how to report an officer’s salary. While most officer salaries are considered to be wages, some situations arise in which an officer’s salary is not considered to be wages. The structure of the company, the duties of the officer, and the amount paid to the officer can be important considerations when determining how to report an officer’s salary for tax purposes.

Is the cost of goods sold an expense?

This approach does no reflect actual usage patterns in most cases, and so is banned by the international financial reporting standards. The gross profit helps determine the portion of revenue that can be used for operating expenses (OpEx) as well as non-operating expenses like interest expense and taxes. The FIFO method assumes the first goods produced or purchased are the first sold, whereas the LIFO method assumes the most recent products produced or purchased are the first sold. The average cost method uses the average cost of inventory without regard to when the products were made or purchased.

Overhead Expenses

Any costs that directly relate to selling your product should be considered part of your cost of goods sold. For example, if you pay employees to assemble your product, both the product’s raw materials and the employees‘ are salaries part of cost of good sold wages are included in your cost of goods sold. These expenses are also known as direct expenses since they relate directly to your product’s creation. Multi-step profit and loss statements are a little more complicated.

- Additionally, the ending inventory is inflated because the latest inventory was purchased at higher prices.

- In these cases, comprehensive cost accounting methods that can allocate overhead and administrative costs more accurately are more informative.

- By subtracting the annual cost of goods sold from your annual revenue, you can determine your annual profits.

- In an inflationary environment, this means that the most expensive (newest) inventory items are charged to expense first, which tends to minimize the reported profit level.

Cost of goods sold: How to calculate and record COGS

Companies that make and sell products or buy and resell goods must calculate COGS to write off the expense. The resulting information will have an impact on the business tax position. For example, COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together. The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded. If COGS is under-reported, it will artificially inflate the profit margin, painting a picture of profitability that may not be fully accurate.

The special identification method uses the specific cost of each unit of merchandise (also called inventory or goods) to calculate the ending inventory and COGS for each period. In this method, a business knows precisely which item was sold and the exact cost. Further, this method is typically used in industries that sell unique items like cars, real estate, and rare and precious jewels. The balance sheet has an account called the current assets account. The balance sheet only captures a company’s financial health at the end of an accounting period. This means that the inventory value recorded under current assets is the ending inventory.

By the end of 2018, Twitty’s Books had $440,000 in sellable inventory. Its primary service doesn’t require the sale of goods, but the business might still sell merchandise, such as snacks, toiletries, or souvenirs. You will often have some administration costs that often require some analysis, but sales is always a „black or white“ classification. The closing inventory refers to any goods still in stock at the end of your chosen period. You need to subtract this number from your opening inventory and total purchases to get your COGS figure.

To calculate it, add the beginning inventory value to the additional inventory cost and subtract the ending inventory value. Consumers often check price tags to determine if the item they want to buy fits their budget. But businesses also have to consider the costs of the product they make, only in a different way. Then your (beginning inventory) + (purchases) – (ending inventory) would result in a negative. Most service businesses—like freelance writers, graphic designers, career coaches, and the like—have little to no costs of goods sold. That’s because the things they need to do their work, like computer hardware and software, remains the same no matter how many pieces of work they create.

You’d simply add up how much it cost to acquire each product and, voilà, you’ve found your beginning inventory’s total value. Finally, the business’s inventory value subtracts from the beginning value and costs. This will provide the e-commerce site with the exact cost of goods sold for its business. Then, the cost to produce its jewellery throughout the year adds to the starting value. These costs could include raw material costs, labour costs, and shipping of jewellery to consumers.

Číst více